The high volatility of Bitcoin and global bear sentiment in the digital asset sector might cause many crypto investors to exit the market.

Previous bearish cycles have seen an 80% reduction in trading liquidity, according to Cointelegraph. The speculators who are the most impatient were the first to leave. The last to leave were HODLers — those who hold to the last, hoping for the growth to resume.

Article content

- 1 Bear cycles. Earlier episodes

- 1.1 2012. The first ghosts of state regulation

- 1.2 2013 – the beginning of 2015. The collapse of the Silk Road and the Bitcoin killing by the Central Bank of China

- 1.3 2015–2020. Rising to $20,000

- 1.4 2021. Money printing by the US Federal Reserve and the “ashes” of fiat

- 1.5 2022. Rising interest rates as a sharp knife for crypto

- 2 What is Bitcoin halving?

Bear cycles. Earlier episodes

What is the catalyst for global pessimism? Bitcoin and other cryptocurrencies (altcoins) have experienced several bearish episodes since their initial appearance on the market. The current episode is about the fifth in a row.

Chart 1. Five bear cycles of BTC dynamics 2012-2022. Source: Trading View.

Let’s go over the previous bearish cycles to approach the current situation smoothly…

2012. The first ghosts of state regulation

A distinctive feature of the period is the uncertainty of legislators, and central authorities, who are slowly starting to become interested in crypto. TradeHill, the second-largest bitcoin exchange, collapses. Hackers attack Bitcoinica and Linode, resulting in the loss of tens of thousands of bitcoins and a market drop of about 40%. The price of BTC bounces briefly, and again sags by 37%.

2013 – the beginning of 2015. The collapse of the Silk Road and the Bitcoin killing by the Central Bank of China

BTC is on the rise again and stays flat at $120 for most of 2013. Then the coin skyrockets to over $1100 in the last quarter of 2013. Then, abrupt events in the market follow. The authorities shut down the shady site Silk Road. The Central Bank of China bans transactions with bitcoin. Painful anxiety is being built up around the closure of the Mt.Gox exchange. These events set the BTC market back for a long 415 days. The bearish phase lasts until the beginning of 2015. However, in this bearish cycle, the price contracts slightly: only 17% from previous market highs.

2015–2020. Rising to $20,000

Bitcoin trades steadily, without significant fluctuations, until mid-2017, when the enthusiasm of investors and the growing crypto community push the price of the coin to the $20,000 mark by December. This is followed by a series of hacker attacks. Fresh rumors are creeping in about increased regulation in the crypto market. BTC has been in the doldrums for over a year, but 2019 lifts the coin to almost $14,000. From there, BTC holds almost always steadily above $10,000 until pandemic fears push BTC below $4,000 in March 2020.

2021. Money printing by the US Federal Reserve and the “ashes” of fiat

The US Federal Reserve launches its magic money printer. The global quantitative easing trend and inflationary concerns about fiat money are driving an unprecedented rise in asset values. Bitcoin rises to $69,000, the total crypto market capitalization exceeds $3 trillion by the end of 2021.

2022. Rising interest rates as a sharp knife for crypto

This is the fifth current bearish cycle and is currently in full swing. Central banks are raising rates in response to unmanaged inflationary growth. All indications are that ahead is a cycle of downtrends characteristic of the immature digital segment. Bearish chaos triggers are high-risk startups, which account for 50-60% of the capitalization of all digital assets in circulation. Bitcoin is trading at around $20,000 at the beginning of June 2022.

Bitcoin is a finger of God for other coins.

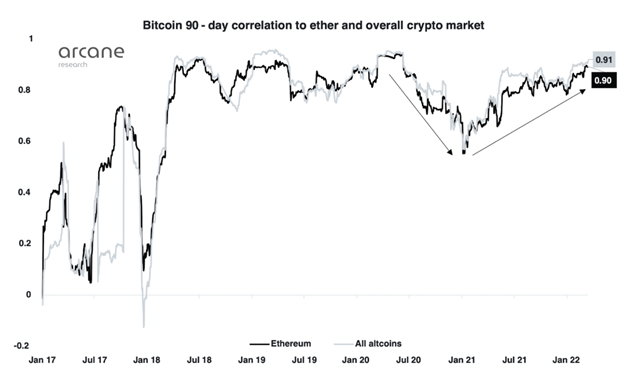

As you can see in the chart, Bitcoin is strongly correlated with the rest of the crypto market — altcoins.

Fig. 1. BTC correlation with ether and all altcoins. Source: Arcane Research.

When Bitcoin fell in earlier cycles, investors most often shifted their capital to stablecoins. But the sad story with Terra and the loss of the dollar peg with the lightning-fast project depreciation showed that stablecoins have even more risks.

The question is, is there light at the end of the tunnel?

Future halving episodes could save Bitcoin. An empty hope or something really valuable?

What is Bitcoin halving?

BTC’s basic digital code suggests that every four years the coin must go through the halving procedure, based on the rule that miners can issue no more than 21 million BTC.

Halving is a 50% reduction in rewards for miners.

On May 11, 2021, another scheduled halving took place: the miner reward was halved to 6.25 BTC. The next halving is scheduled for March 2024.

Fig. 2. BTC halving dates. Source: Trading View.

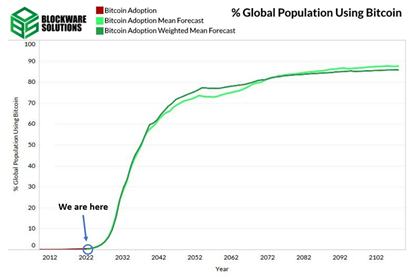

The analyst from Blockware Solutions believes that Bitcoin halving is a clear benchmark for a long-term bullish reversal.

As an illustration of his statement, the expert cites a graph depicting the correlation between the level of mass acceptance of Bitcoin and the volume of emission of a digital asset.

Fig. 3. Trends in Bitcoin mass adoption since 2012. The maroon line is the actual acceptance rate. The dark green and light green lines are Blockware Solutions’ average and weighted average forecasts based on historical data.

The point on the graph relating to 2022 is the actual start of the mass introduction of the coin into wide circulation when an increasing number of people begin to use Bitcoin not only as a speculative investment but also as an intermediate means of payment in the real economy.

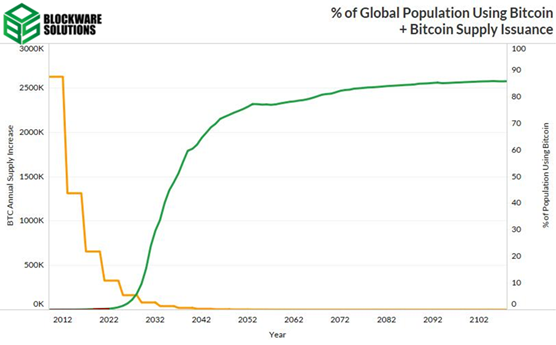

The analyst notes that this chart inspires him with final and irrevocable optimism, showing a reduction in the BTC’s supply against the backdrop of an increase in demand for the coin.

Fig. 4. Exponential growth in the number of bitcoin users coupled with bitcoin supply shrinking at regular intervals (halving every 4 years).

Still, bullish growth will not happen now, but a little later …

Despite long-term optimism, BTC could still face a lot of volatility. Too much external pressure: the US Federal Reserve and interest rates, the risks of increased regulation, an unstable geopolitical backdrop…

The influence factor of halving is not a momentary matter. The effect of shrinking BTC volumes in circulation is cumulative. The more halving episodes and the fewer Bitcoins in the public domain, the higher the level of mass use of the coin and the higher the demand and price.

Would you like to learn how to trade cryptocurrencies, currency pairs, stocks, and other instruments? Subscribe to the AMarkets YouTube channel and follow the daily trading recommendations. Get valuable tips with entry and exit points for a certain market asset!