Ever wondered why markets can seem so unpredictable? Even when there’s no clear economic reason, stock, currency, and commodity prices can swing wildly. The answer often lies in market sentiment – the collective emotional mood of traders.

Article content

Market Sentiment: A Driving Force

Market sentiment can push prices up or down, often regardless of underlying fundamentals. Fear can cause sharp drops, even with a positive economic outlook. Conversely, optimism or greed can lead to overvalued prices. Understanding market sentiment helps you anticipate these shifts and make better trades.

Measuring Market Mood

News can influence prices, but it’s often emotions that drive the reactions. Positive news can create excitement, while negative news can trigger selling. Luckily, we can measure these emotions.

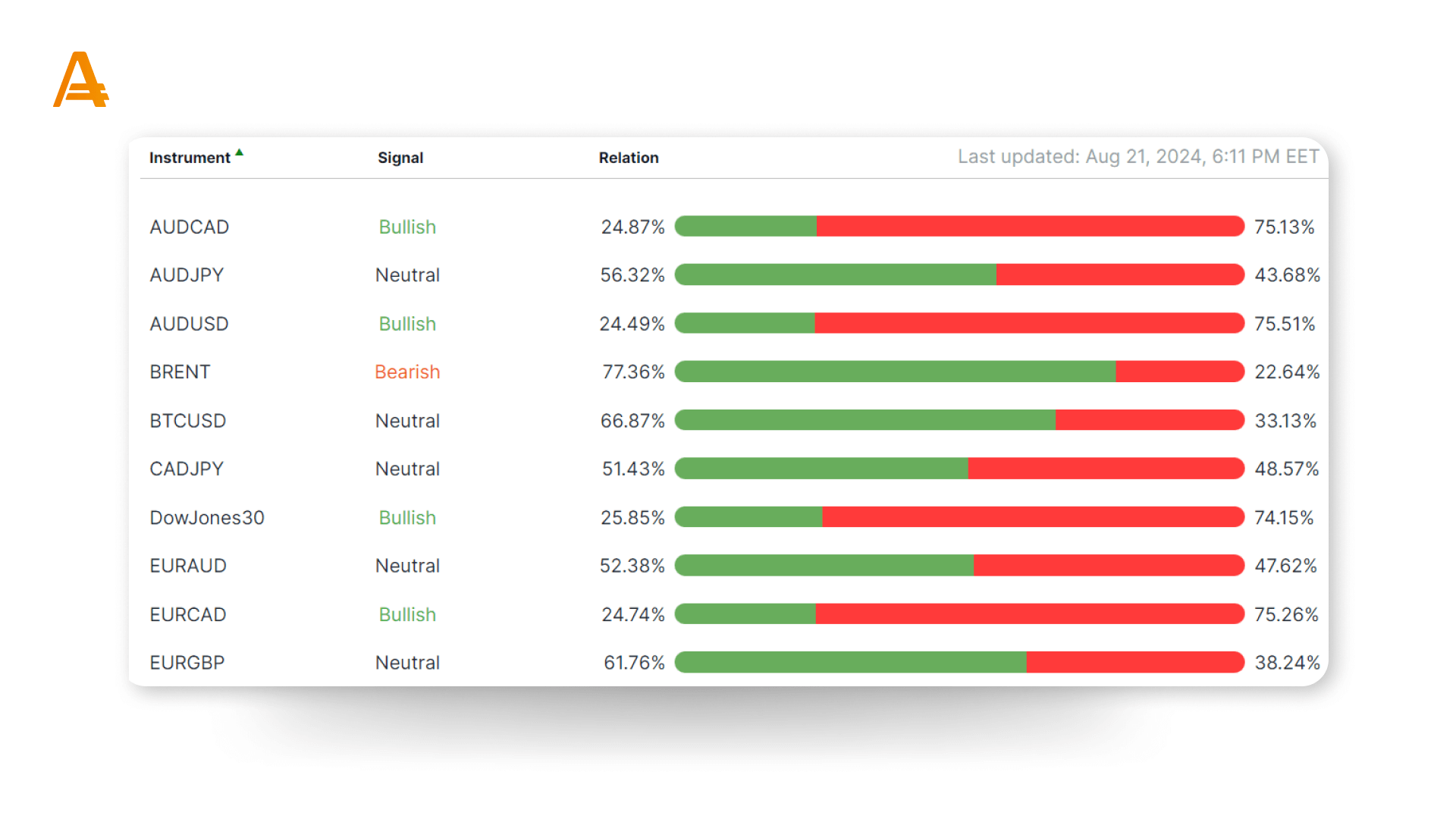

The sentiment indicator shows the ratio of buyers to sellers for each asset. If one side dominates by 70% or more, it might signal an overbought or oversold condition. Markets often trend towards the minority side (30% or less).

How the Sentiment Indicator Works

The indicator tracks the buyer-to-seller ratio. When one side exceeds 70%, it suggests an overbought or oversold asset. This often indicates a potential shift towards the minority side.

Interpreting the Sentiment Indicator:

- ≤ 30: Oversold, suggesting a possible buy signal.

- ≥ 70: Overbought, indicating a potential sell signal.

- 30-70: Neutral zone, generally avoid trading.

Combining Fundamentals and Sentiment

In trading, fundamentals (economic data, news) and sentiment are two sides of the same coin. Fundamentals determine an asset’s value, while sentiment reflects trader emotions.

By understanding both, you get a clearer picture. For example, negative sentiment might temporarily drive prices down, even with strong fundamentals. This knowledge helps you make informed decisions, balancing logic with an awareness of market emotions.

Now that you understand market sentiment, let’s explore how emotions influence trading decisions and learn strategies to minimize their impact.