What makes a successful Forex trading strategy? The options are plentiful. Some traders swear by fundamental analysis, others by news-based trading, and others by technical indicators. Then, there are those who focus on trading volume.

This article will explore the idea of how trading volume influences currency rates, clarify some common misconceptions, and ultimately determine if this strategy is viable in the Forex market.

Article content

What is Volume-Based Trading?

Everyone understands the basic concept of supply and demand: when demand outpaces supply, prices rise, and vice versa. This principle is the foundation of volume-based trading. Traders using this strategy aim to:

- Identify whether buyers or sellers are more dominant in the market.

- Correlate this information with price movements.

- Execute buy or sell orders accordingly.

- Close the trade when supply and demand are balanced again.

Origins of Volume-Based Trading

The concept of supply and demand is absolutely correct for almost any goods and services. You don’t need to be a professional trader to understand that if there is only one store in the city, the prices there will be higher than in a neighboring city with 5-6 stores.

But the idea of volume-based trading on Forex did not come from commodity markets. Essentially, it is an evolution of the ideas of the legendary trader Richard Wyckoff. In the first half of the 20th century, he developed the VSA (Volume Spread Analysis) strategy. Wyckoff carefully considered various aspects of his method and introduced key concepts that are still used by traders worldwide.

For example, he divided the trading cycle into an accumulation phase and a distribution phase. In the first phase, key players prepare to make decisions, and the market is flat. During the second phase, large purchases or sales of the asset occur, and the chart actively moves up or down. It’s worth noting that Wyckoff’s strategy, widely promoted by some Forex traders today, has remained almost unchanged.

What Tools Do Volume-Based Traders Use?

There are primarily two types of tools employed by volume-based Forex traders. The first is tick volume data, which visually represents the number of price changes (ticks) within a given timeframe:

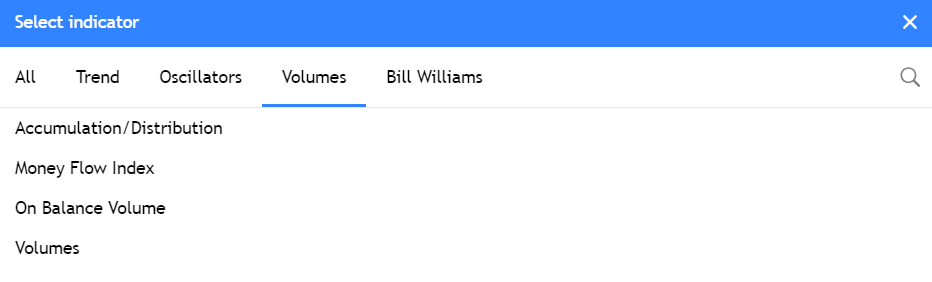

Secondly, there are four main volume indicators commonly found in the “Volumes” tab:

While these tools can provide valuable insights into market sentiment, it’s crucial to understand that volume data alone isn’t enough to predict price movements accurately. A closer look at VSA literature reveals that it’s often described as a complementary strategy rather than a standalone approach.

What’s the Problem?

To understand the challenges, let’s revisit Richard Wyckoff’s era. Back then, trading volumes were easily observable. Trades took place on physical exchange floors, with traders shouting orders and prices.

How different is today’s Forex market? Most traders now use electronic platforms, often from remote locations. This makes it impossible to gauge trading volume intuitively. Therefore, you need a reliable source to provide you with this information.

Unfortunately, there’s a significant issue. Forex is a decentralized market, meaning there’s no central authority collecting and distributing trading volume data. But what about the volume data in the trading terminal? The answer is simple. If you read carefully, you noticed that we were talking not about “volumes” but “tick volumes,” and these are completely different data. Tick volumes refer to the number of ticks (price changes) per unit of time. Many novice traders are misled by the similarity of terms.

The indicators listed above face the same problem. In one of the following articles, we will analyze them in more detail. For now, suffice it to say that they also don’t measure true trading volume but instead compare price bars or candles using specific formulas. The reason is the same — true volume data does not exist.

Conclusions

Trading based on volume data is not very applicable in the Forex market due to the inaccessibility of this data to traders and brokers. However, tick volume and related indicators can still be valuable tools when used in conjunction with other analysis methods. We’ll explore these tools and their potential applications in more detail in future articles.