Many traders, both new and experienced, use news releases to their advantage. It seems logical: economic reports, political events, and other news can significantly impact currency prices. However, simply matching news with price charts isn’t enough.

False market movements can easily lead to losses. In this article, we’ll explore what these false movements are, how they happen, and how you can protect yourself from their negative effects.

Article content

Understanding False Market Movements

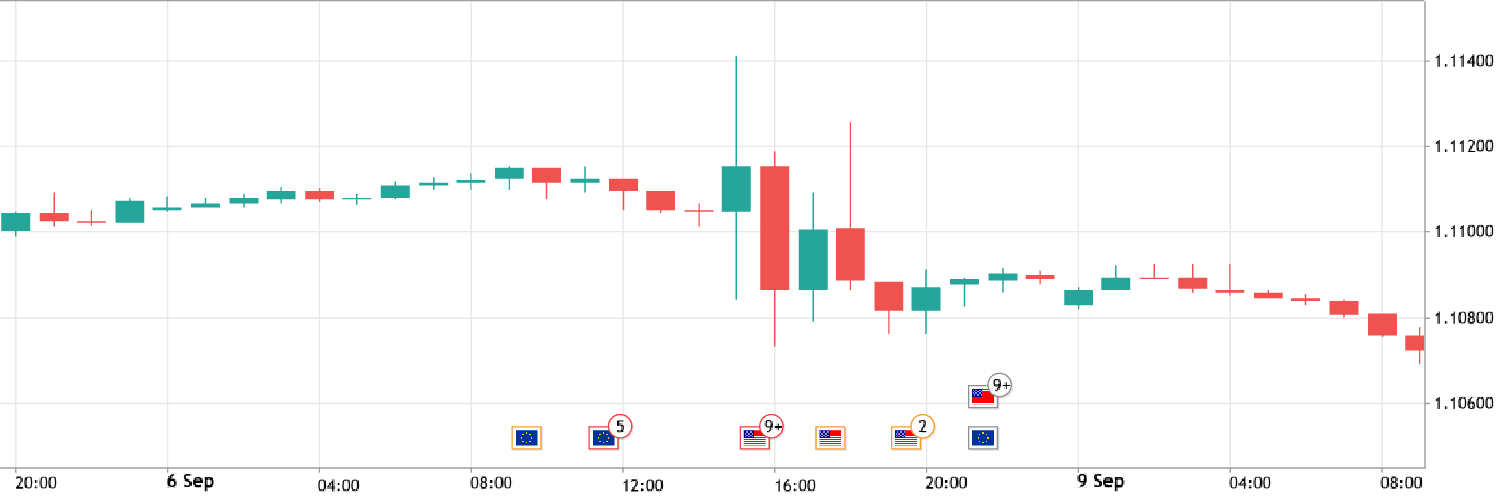

News can be either expected or unexpected. We’re talking about expected news here – the kind you can anticipate and prepare for. When news is released, it can align with forecasts, be better than expected, or worse than expected. Traders usually buy or sell based on this information. In theory, the market should move in a predictable direction after news is released. But that’s not always the case. False market movements happen when the price chart moves unexpectedly, going against what traders predicted. This is how false market movements look on a chart:

Here are three signs to watch for:

- Quiet before the storm. Often (but not always), there’s a period of little or no price movement before a false movement (flat market).

- Explosive start. The first candlestick after the news often has a long shadow, showing a sudden burst of volatility.

- Wrong way, quick. After the initial surge, the market might reverse direction or become flat again, going against the direction of the long shadow.

Why False Market Movements Happen

Imagine opening a trade expecting the price to move steadily in one direction, only to see it go the opposite way. This is a false market movement. But why do these happen? Here are some reasons:

- Market emotions. The market is highly influenced by the psychological reactions of traders. You’re not the only one eagerly waiting for a news release – millions of traders are reacting to news at the same time, causing sharp price fluctuations.

- Misreading the news. The market is complicated. Sometimes, traders might misunderstand news. For example, good unemployment numbers might seem positive at first, but then traders may discover that the improvement was due to a change in how the data was calculated.

- Algorithmic trading. Big companies and banks often use computers to trade. If the outcome of a news release is predictable, these algorithms can trigger massive buy or sell orders, causing sudden market reversals.

- Market manipulation. While some false movements happen accidentally, others result from intentional actions by big players. They may deliberately cause price swings to confuse retail traders and profit from the sudden reversals.

How to Avoid the Impact of False Movements

While false market movements can’t be completely eliminated, you can use these strategies to reduce their impact and protect your trades:

- Set limits. Always use stop-loss and take-profit orders. This helps you avoid making decisions based on emotions and protects you from unexpected surprises. By setting these limits, you can prepare for different market scenarios without constantly watching the screen.

- Follow trends. Wait for a clear trend to form after major news. This might mean missing quick opportunities, but it can help you avoid risky trades. News that strongly affects trends doesn’t happen often, so you don’t need to watch the market all the time.

- Understand the big picture. Always look at the whole situation when analyzing news. Study the history of the trading instrument you’re interested in and see how past news affected it. The more you know, the less likely you are to be surprised by false movements.

Remember, sticking to your trading plan and managing your emotions is key. Set clear rules for buying and selling, and decide on the right amount to invest and the limits for your trades. If you feel anxious or tempted to break your rules, take a break. Remember, success in trading isn’t about one trade, but making consistent profits over many trades.